![]()

In the fast-paced world of finance, it’s crystal clear that banks and credit unions need to catch the digital drift and amp up their pre-approved offer game in 2024. Change is in the wind, and some institutions are standing at a bit of a crossroads where going digital isn’t just some fancy option—it’s a need-to-have. It’s not just about meeting expectations; it’s about smashing them out of the park for the modern consumer. Consumers today expect their financial institutions to grow with them and offer an easy-to-use experience similar to what they get with Google, Apple, or any other tech-focused brand. SavvyMoney wants to help you be that tech-forward financial institution. Shifting to digital isn’t just brilliant—it’s a win-win, backed by actual data!

1. Enhanced Customer Experience

User-Friendly Interfaces: Digital platforms allow for intuitive and user-friendly interfaces, making it easier for consumers to navigate, understand, and redeem their pre-approved offers.

24/7 Accessibility: Embracing digitization allows consumers to tap into pre-approved offers whenever and wherever they want. This offers the flexibility they crave and adds a layer of convenience to the entire experience.

2. Data-Driven Decision Making

Advanced Analytics: Digital platforms leverage advanced analytics tools to analyze vast consumer data. This data-driven approach enhances decision-making, allowing for more targeted and effective pre-approved offer campaigns.

Right Place, Right Time: Harnessing the power of data-driven insights, we can utilize machine learning and predictive modeling to anticipate consumer behavior. This approach not only refines the precision of targeting pre-approved offers but also substantially elevates acceptance rates.

3. Personalization and User Engagement

Tailored Offers: 45% of consumers are willing to share personal information if they believe it will result in better services or products. That leads to a better consumer experience.

Multi-Channel Engagement: Integrated digital platforms allow consistent and personalized communication across various channels, fostering stronger connections between financial institutions and their consumers.

4. Operational Efficiency and Cost Reduction

Automation: Digitizing pre-approved offer processes reduces manual intervention, minimizes the likelihood of errors, and improves overall operational efficiency.

Streamlined Processes: The shift to digital eliminates the need for extensive processes, reducing costs associated with marketing and lending teams.

5. Regulatory Compliance and Security

Compliance Features: Digital platforms often come with built-in features that ensure compliance with industry regulations and standards, reducing the risk of regulatory issues.

Enhanced Security Measures: Robust security protocols, including encryption and secure authentication, help protect sensitive consumer information and instill trust in the digital banking experience.

6. Agility and Adaptability

Quick Updates and Modifications: Digital platforms can be easily updated to reflect changes in regulations, market conditions, or consumer preferences, allowing banks and credit unions to adapt swiftly to evolving circumstances.

Scalability: Digital solutions can scale to accommodate increased demand, ensuring the infrastructure can support growing consumers and transactions.

7. Competitive Positioning

Differentiation: Banks and credit unions that embrace digital transformation can differentiate themselves in a competitive market, attracting tech-savvy customers seeking modern and innovative financial services.

Continuous Improvement: Digital platforms allow financial institutions to gather feedback and improve their pre-approved offer processes based on customer insights and changing market dynamics.

8. Adaptation to Changing Demographics

Catering to Younger Generations: Digitization aligns with the preferences of younger generations, who are more accustomed to digital interactions, ensuring that banks remain relevant to a changing consumer demographic.

Multi-Generational Reach: By offering pre-approved offers through digital channels, banks can effectively reach and engage consumers across different age groups and demographics.

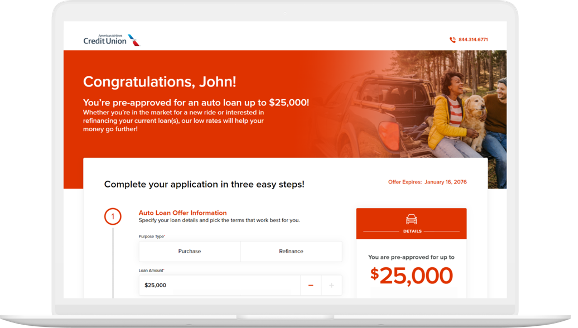

American Airlines Pre-Approval Experience

Transitioning to a digital pre-approval strategy in 2024 is not merely advantageous—it’s essential for banks and credit unions. Embracing digital transformation enhances customer experiences, drives data-informed decisions, and boosts operational efficiency while ensuring compliance and security. By adopting a digital approach, financial institutions can offer personalized, timely, and accessible services that meet modern consumer expectations. This strategy helps retain existing customers and attracts tech-savvy new ones, providing a competitive edge in the market.

SavvyMoney already supports over 1,300 financial institutions and is here to support you on your journey to becoming a tech-forward financial institution, empowering you to exceed consumer expectations. As we step into a new era of financial services, going digital with your pre-approval strategy is the win-win approach your institution needs to thrive.