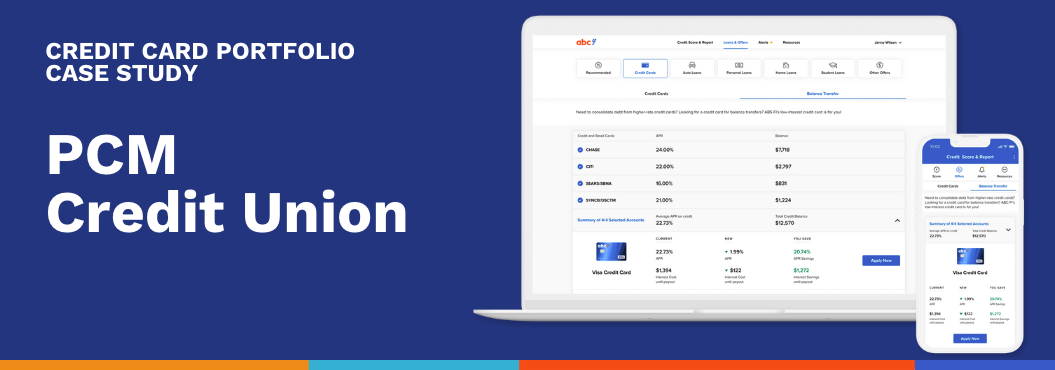

How SavvyMoney was able to help PCM Credit Union see a 67% increase in their credit card portfolio.

AT A GLANCE

About PCM Credit Union: 14,450+ members, $450MM in assets

SavvyMoney Partnership: Launched March 2017

Impact: 67% Increase in credit card portfolio

OPPORTUNITY

PCM Credit Union (PCM) was seeking to target its members with an offer that would not only expand its credit portfolio but also deliver savings to them. With over 14,000 members, PCM aimed to provide access to financial tools that would position them for future lending opportunities.

SOLUTION

After thorough research and collaboration with its digital banking partner, PCM opted to integrate SavvyMoney into its digital banking platform. This decision enabled PCM to offer its members a comprehensive financial wellness solution.

PCM leveraged two pivotal components of SavvyMoney for their credit card campaign. First, they deployed a digital banking advertisement that showcased pre-qualified offers tailored to users’ credit scores and consumer tradeline attributes. This personalized approach enhanced the user experience and drove significant engagement. Second, PCM utilized the SavvyMoney Analytics platform to conduct targeted email campaigns. These campaigns specifically targeted users with excellent credit who carried unsecured credit card debt outside the institution. The overarching strategy was designed to capitalize on balance transfer opportunities and promote PCM’s credit card offerings.

IMPACT

PCM experienced a remarkable increase in engagement, leading to a 2x increase in credit card applications. This heightened activity translated into an impressive 120% surge in new credit card accounts compared to the previous reporting period. As a result, PCM has witnessed a remarkable 67% growth in its credit card portfolio between 2022 and 2023, affirming the invaluable role of SavvyMoney’s partnership in fostering growth and enhancing member savings.

“At PCM, we’ve found SavvyMoney to be a game-changer. Our members appreciate the fact that they’re not inundated with offers from other financial institutions; instead, they’re presented with tailored offers that reflect estimated rate and payment savings, personalized to their unique circumstances. Our recent campaign, promoted through the solution, has been instrumental in achieving our growth targets. Beyond the solution itself, the team at SavvyMoney has consistently impressed us with their expertise and unwavering support.”

-Lesley Enz, Senior Director of Marketing & Strategic Partnerships