SavvyMoney Launches Get My Rate: First Personalized Offer Automation Tool for Financial Institutions

New tool streamlines personalized loan offers for financial institutions

Dublin, CA, July 22, 2024 – SavvyMoney, a company powering innovative, market-leading credit score solutions, today announced Get My Rate, the first personalized offer automation tool designed exclusively for financial institutions (FIs).

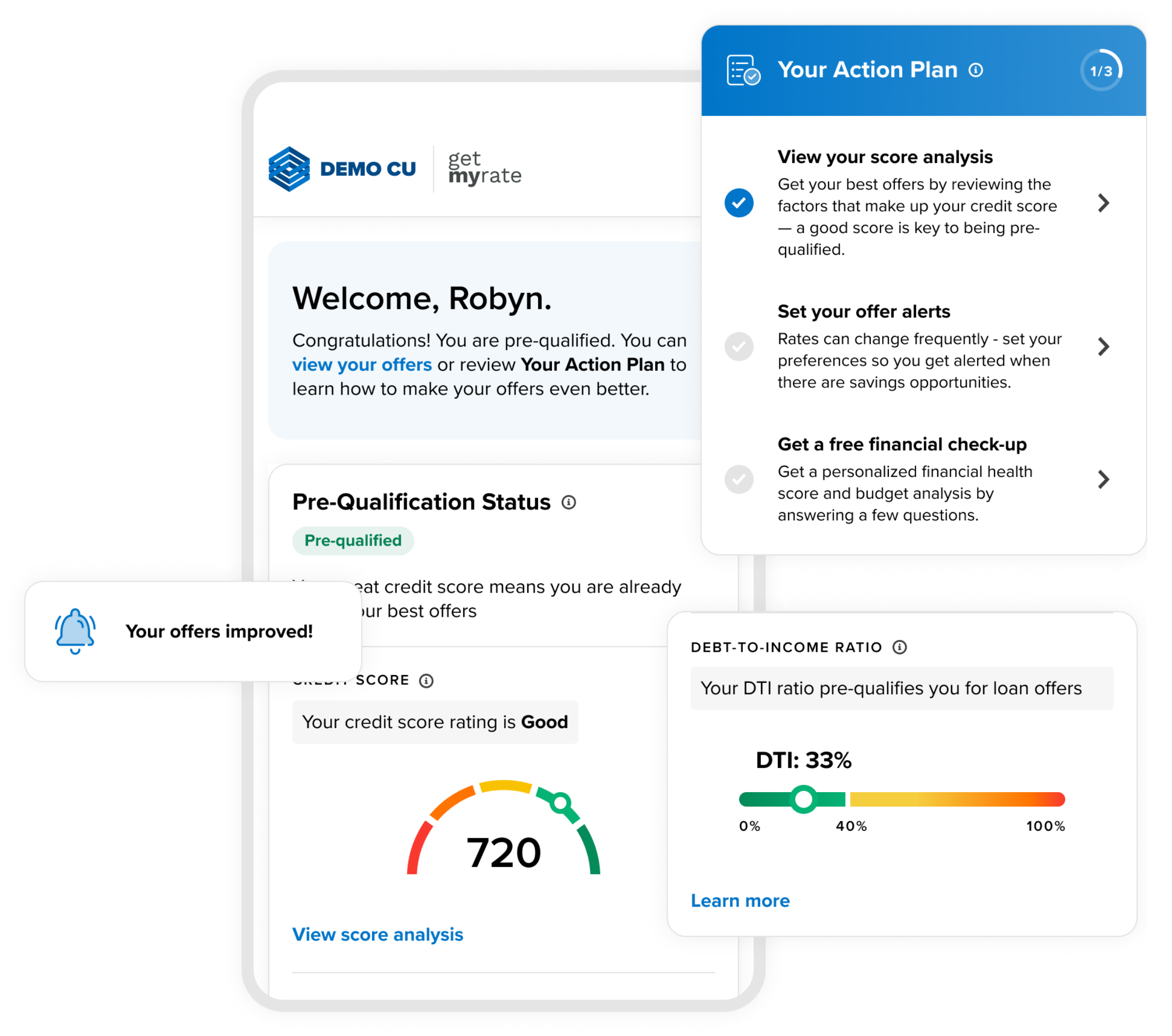

The new, customized offer tool is set to transform the way FIs interact with members and non-members, providing unmatched convenience, tailored experiences, and enhanced market reach. Get My Rate also seamlessly integrates consumers into the FI’s marketing efforts, ensuring that as their credit profile improves over time or as rates improve, they are presented with pre-qualified loan options featuring the latest rates in line with their credit qualifications.

The new, customized offer tool is set to transform the way FIs interact with members and non-members, providing unmatched convenience, tailored experiences, and enhanced market reach. Get My Rate also seamlessly integrates consumers into the FI’s marketing efforts, ensuring that as their credit profile improves over time or as rates improve, they are presented with pre-qualified loan options featuring the latest rates in line with their credit qualifications.

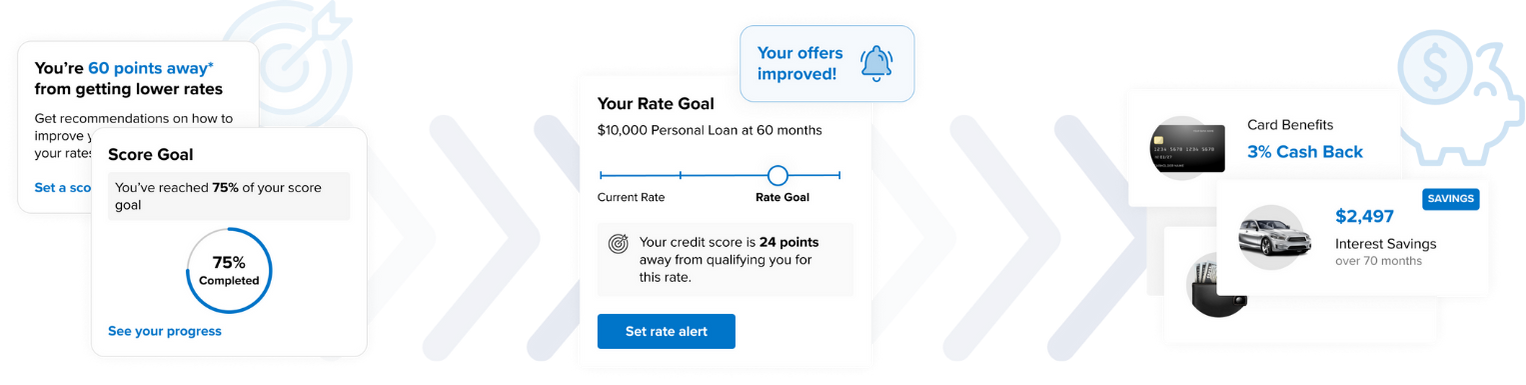

Unlike other conventional, single-stop pre-qualification solutions in the market, Get My Rate allows users to get pre-qualified for multiple offers simultaneously and receive ongoing alerts when rates change in their favor. Additionally, users benefit from continuous credit monitoring and a comprehensive set of financial wellness tools, which guide them toward improving their financial profile over time. These improvements can unlock better loan opportunities and significant cost savings for consumers.

“SavvyMoney is thrilled to introduce Get My Rate — the first tool of its kind — marking a new era of convenience, empowerment, and expansion,” stated JB Orecchia, President & CEO of SavvyMoney. “Given credit criteria and rates change all this time. This solution provides a personalized solution that alerts consumers when the product or rate meets their needs. In an industry that’s rapidly evolving with digital transformation and increasing consumer expectations, it truly exemplifies our commitment to reshaping the lending landscape, putting the power of personalization in the hands of consumers while driving continued growth for financial institutions.”

Other key features and benefits of Get My Rate include:

- Streamlined consumer pre-qualification for loans, eliminating uncertainty and stress

- Alerting consumers of progress regarding credit improvement goals to pre-qualify

- FIs enabled to effortlessly identify and market personalized offers to consumers

- Expanded market share by simplifying borrowing on consumers’ terms

- Multi-offer pre-qualification and ongoing rate change alerts

- Continuous credit monitoring and financial wellness tools

- Long-term relationship building between FIs and consumers

“In today’s fast-paced financial landscape, consumers expect personalized, convenient experiences. Our new offer automation tool meets this demand head-on, revolutionizing how financial institutions connect with both members and potential customers,” said David Dowhan, Chief Product Officer at SavvyMoney. “By providing tailored loan options based on real-time credit profiles, we’re not just streamlining the lending process – we’re creating a more transparent, empowering financial journey for consumers while driving growth for our partners.”

SavvyMoney Launching Get My Rate marks a significant milestone in the convergence of finance and technology, providing FIs with the power and agility of a fintech while serving as a powerful customer acquisition tool. By offering free access to pre-qualification and tools that help consumers improve their financial wellness over time, FIs can establish long-term relationships with consumers that go beyond the typically transactional nature of loan origination. This innovative approach underscores SavvyMoney’s commitment to redefining the financial landscape with customer-centric solutions that push the boundaries of traditional banking.

To learn more about SavvyMoney and its solutions for banks and credit unions, please visit beta.savvymoney.com.

###

About SavvyMoney

A leading provider of credit score solutions, SavvyMoney serves over 1,300 banks, credit unions, and fintechs nationwide. SavvyMoney’s solutions integrate seamlessly with over 40 online banking platforms by combining real-time data with digital personalization tools. SavvyMoney’s innovative technology is backed by hands-on service and a commitment to helping financial institutions strengthen and deepen their customer relationships. To learn more about SavvyMoney, visit beta.savvymoney.com.

CONTACT:

BLASTmedia for SavvyMoney

Ryan Sonnenberg

Director of Marketing, SavvyMoney