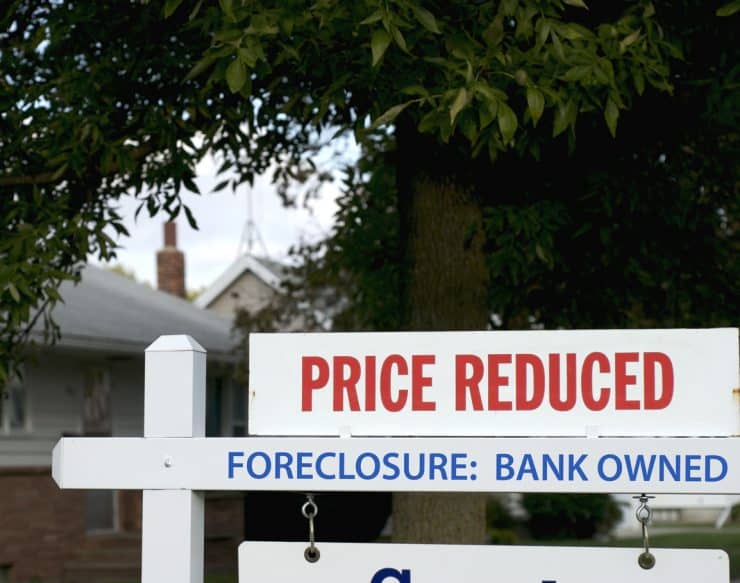

If you’re on the hunt for an affordable home, you might want to keep an eye out for foreclosed properties. Foreclosures typically happen when homeowners cannot afford to pay their mortgages; lenders then take over the property and try to sell them at what are often dramatically reduced prices. The result can equal big savings for you, if you’re up to the task.

With the economy on the upswing, the number of foreclosures available has declined. As US News reports, “distressed” home sales — that includes foreclosures and short sales (selling a home for less than the amount owed on it) — accounted for 14 percent of all home sales last year. That’s down from 15 percent in 2016 and way down from the high mark of 38 percent in 2011. That’s a good thing. It means more homeowners are able to keep up with their mortgage payments. Despite the dwindling numbers, there are still many foreclosures to be had. If you can find one, it can mean significant savings — foreclosures can be as much as 15 percent cheaper than neighboring properties.

What’s your first step? Check the listings at banks like Wells Fargo, Bank of America, Citi etc., and lenders like Fannie Mae. If you find a place you like, aim to amass as much cash as you can. Distressed home sellers love cash offers, because it means they can sell the home without a home appraisal or inspection. And make sure you understand the risks. Foreclosures are sometimes such a great deal because they’re in less than ideal condition. You don’t really know what you’re going to get. There’s also a lot of competition for foreclosures, so you need to be ready to experience several lows before hitting that high. However, if you can stomach the process and understand what you’re getting into, a foreclosure just might be the right move for you. (Pun intended.)