Analytics

Drive Loan Growth with Actionable Insights.

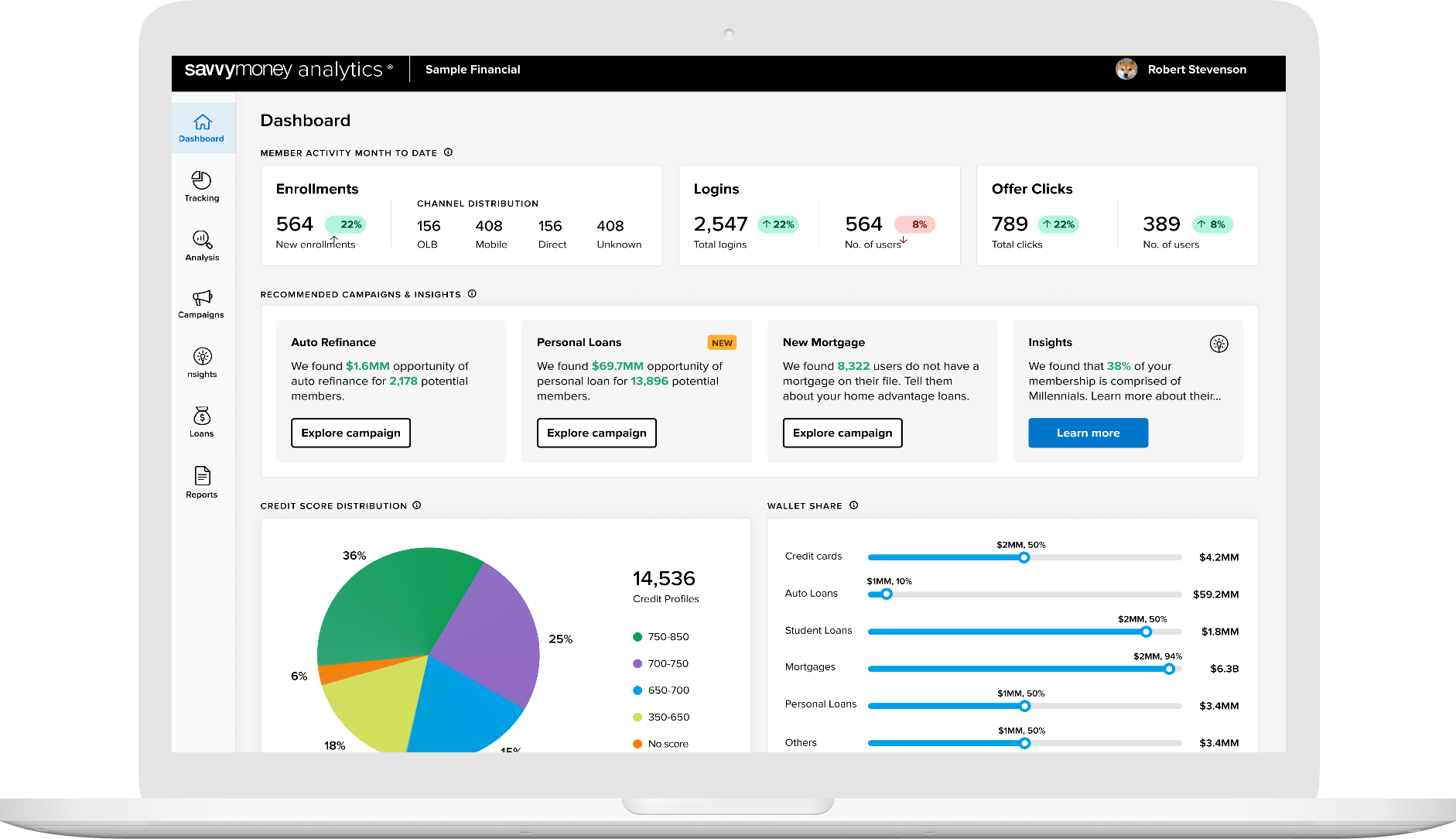

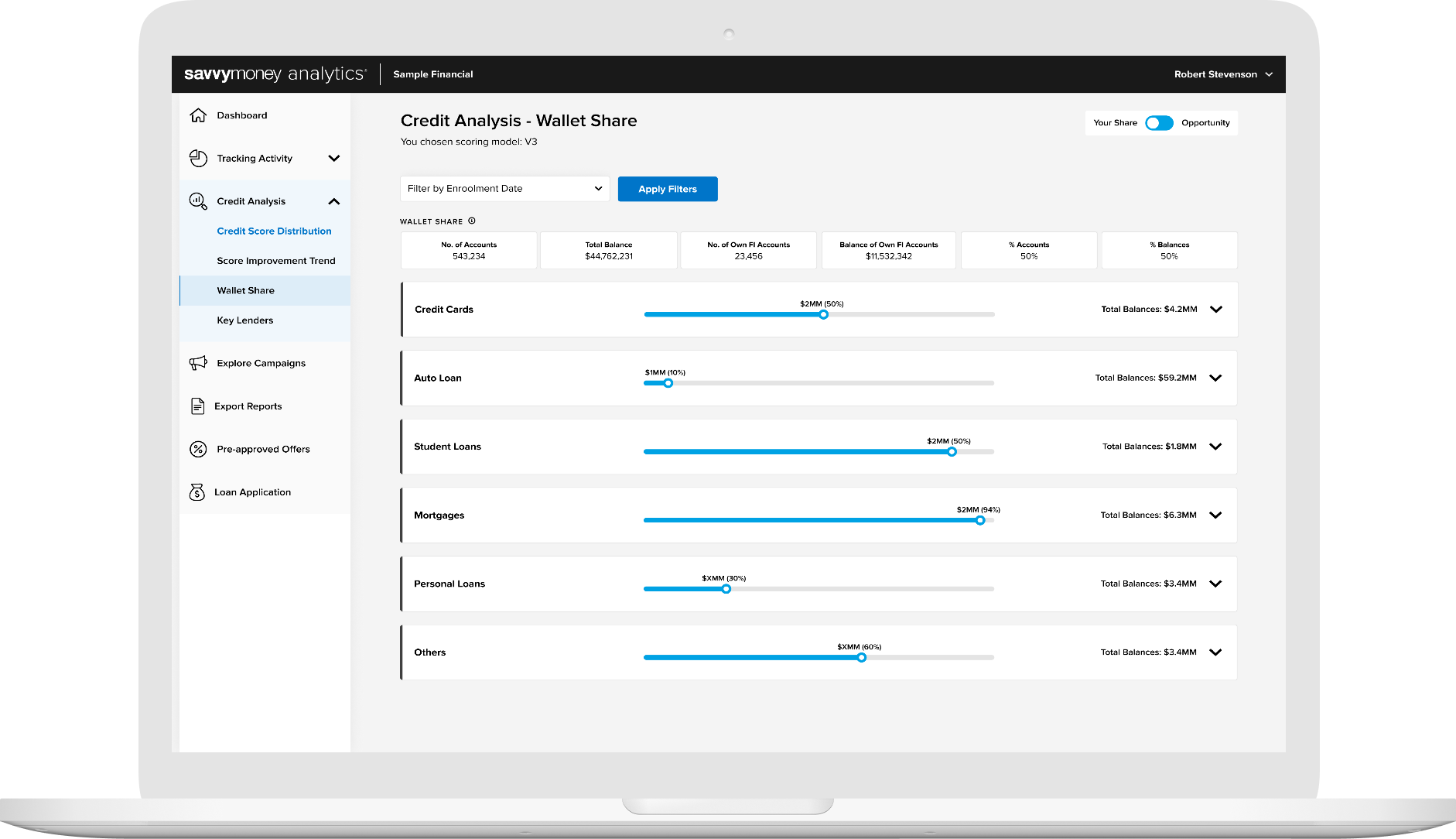

Strategic Segmentation

Analyze your portfolio to identify pockets of opportunity

Credit analysis

Track participation & improvement by credit score tier

Performance tracking

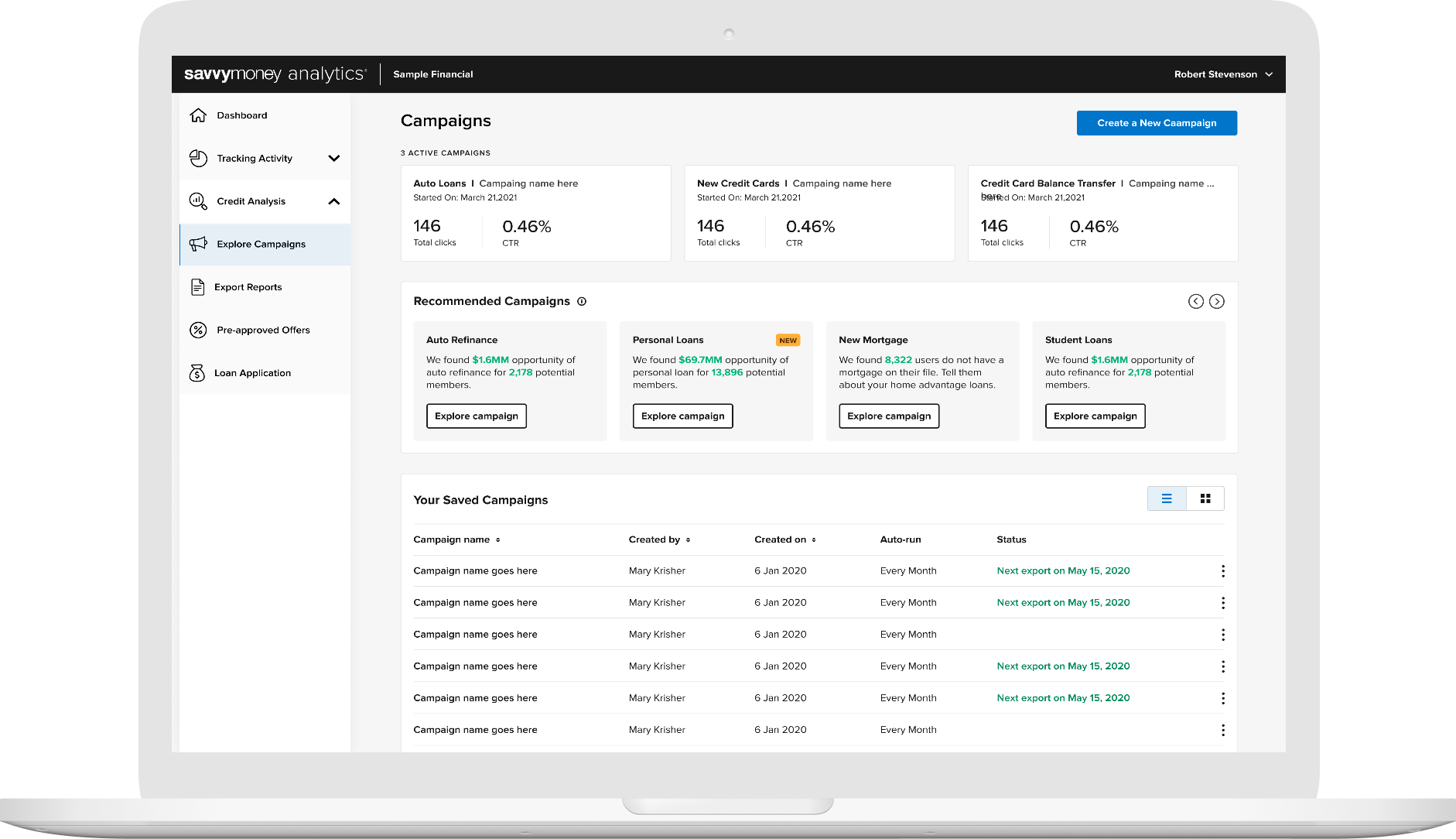

Understand how to better engage customers with loan offers & products

Campaign management

Track engagement & tradeline details to effectively re-target users

100%

INCREASE IN campaign conversion with savvymoney’s targeting data

Increase Loan Volume.

Our solutions uncover key competitive intel. You’ll have full visibility into where your customers are borrowing so that you have the tools to gain greater share-of-wallet.

Uncover Opportunities.

Easily identify lending opportunities, making the right offer to the right customer — and streamlining marketing dollars.

“With SavvyMoney, we’re able to quickly translate credit data into targeted campaigns. Members have been receptive to our offers especially when they can see the personalized savings we can offer.”

HOWARD HEINRICH, VP OF CONSUMER LENDING

COVANTAGE CREDIT UNION

Book a Demo!

If you are a financial institution and want to learn more, fill out this form and our team will get back to you soon.

If you are a consumer or end user with a question about SavvyMoney, send us an e-mail: support@savvymoney.com